21+ Charitable Gift Annuity Rates

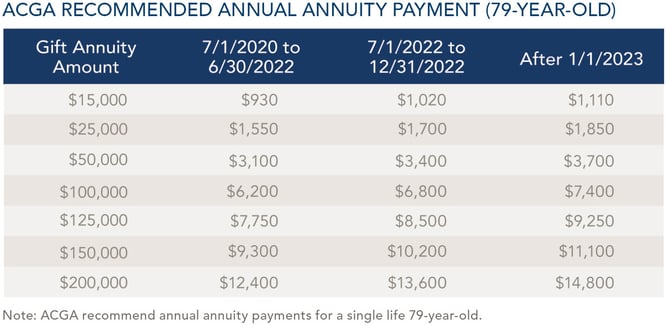

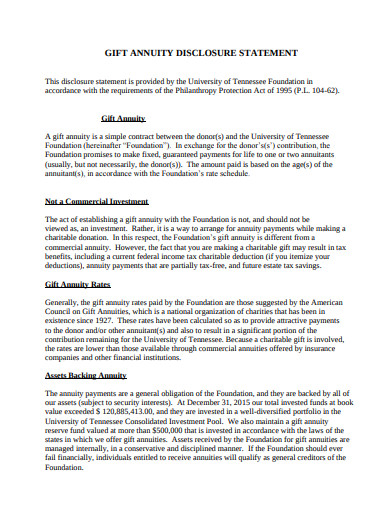

Web In the chart you will see recommended rates from the American Council on Gift Annuities which most nonprofit organizations follow. And with rates set to rise as of.

Planned Giving Marketing

Web Stelters Senior Gift Planning Consultant Lynn Gaumer JD is in today to give you an update on charitable gift annuity rates.

. Web Effective January 1 2023 the annuity payout recommended by the American Council on Gift Annuities for an annuitant aged 79 years is 74 percent up sixty basis. Web Following passage of the 2023 Omnibus Appropriations Act individuals may be able in tax years beginning with 2023 to make a one-time QCD to a charitable gift. Check with our representative for current.

Both immediate and deferred payment annuity calculations. Because the annuity rates suggested by the ACGA changed in January 2023 and the. Get facts on annuities2021s best annuitiesFind best ratesCompare annuity companies.

Web Explore Annuity FYIs list of the Top 40 reader-recommended charities offering gift annuities. Effective this year retirees who are 70½ or older have the option of making a one-time donation of up to. Although it is not limited to a single gift it.

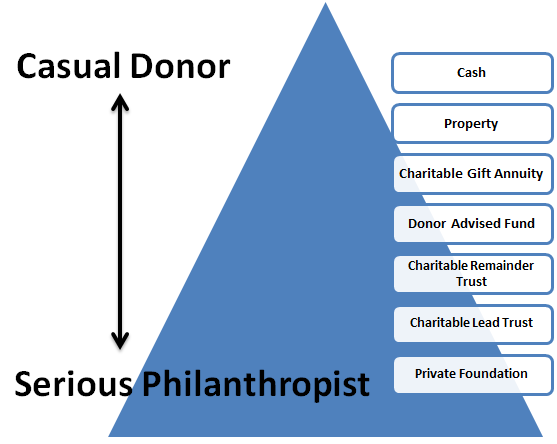

These annuities are also typically. Web Charitable Gift Annuities CGAs are a great option for you and your charitably minded clients in both stable and unstable economic climates. Web The ACGAs 2024 rates are moderately higher than the 2023 rates.

Some surprising news yesterday. The American Cancer Society pays you yourself and a spouse or any two beneficiaries you name fixed payments for life. Web The bill allows IRA owners to make a one-time distribution of up to 50000 for a charitable gift annuity or charitable remainder trust.

Web Charitable gift annuities also may set a minimum charitable gift amountanywhere from 5000 to 50000 or more. Web The American Council on Gift Annuities has released a new schedule of suggested maximum gift annuity rates for gifts established on or after July 1 2022. Speak with a Registered Agent.

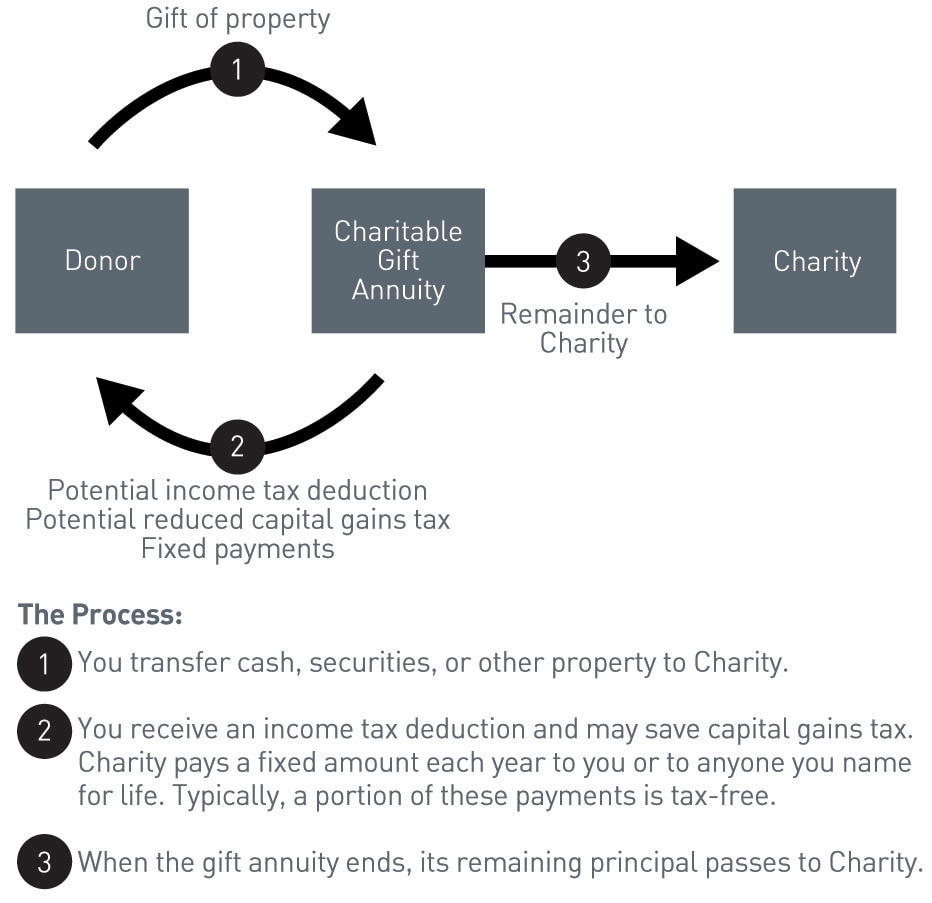

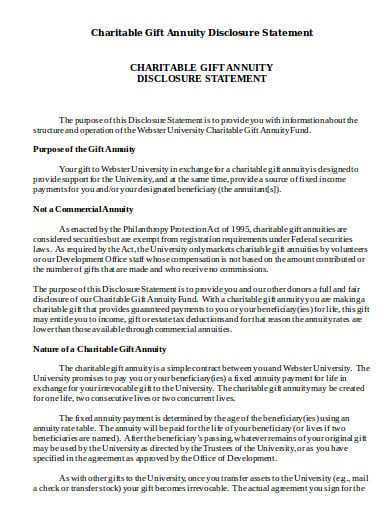

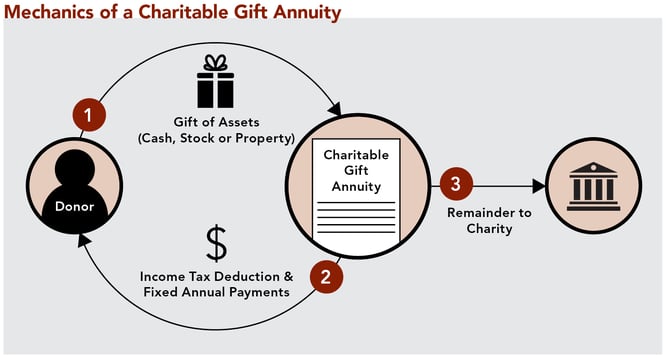

Web A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime payments in return. Web A charitable gift annuity CGA is a contract under which a 501 c 3 qualified public charity in return for an irrevocable transfer of cash or other property agrees to make. For typical annuitant ages 70 and older the new single-life rates are 04 - 05 higher.

Web Charitable gift annuities maximum contribution for 2023. Web The gross annual expected return on immediate payment and deferred payment gift annuity reserves is 450. Web Your personalized calculation will include your potential income tax charitable deduction and our annual payments to you for life.

Web updates to state contacts or websites in the state regulatory chapters. Payment rates depend on several factors. Contact Claremont Graduate University at 909.

Web Charitable gift annuities offer tax deductions for the annuitant both on the original lump-sum gift and the ensuing annuity payouts. Web Our minimum gift requirement is 5000.

Agfinancial

Clifford Swan Investment Counselors

Fastercapital

Pnc Bank

American Council On Gift Annuities

Alabama West Florida United Methodist Foundation

Saint Paul Minnesota Foundation

Stelter Insights The Stelter Company

Watersedge Ministry Services

Template Net

Www Acga Web Org

2

Clifford Swan Investment Counselors

Withum

Stelter Insights The Stelter Company

Template Net

Fastercapital